Common stock value calculator

See our Historical Stock Information page for information on splits. If you acquired your ATT Inc.

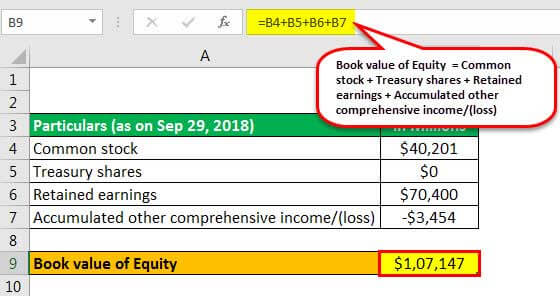

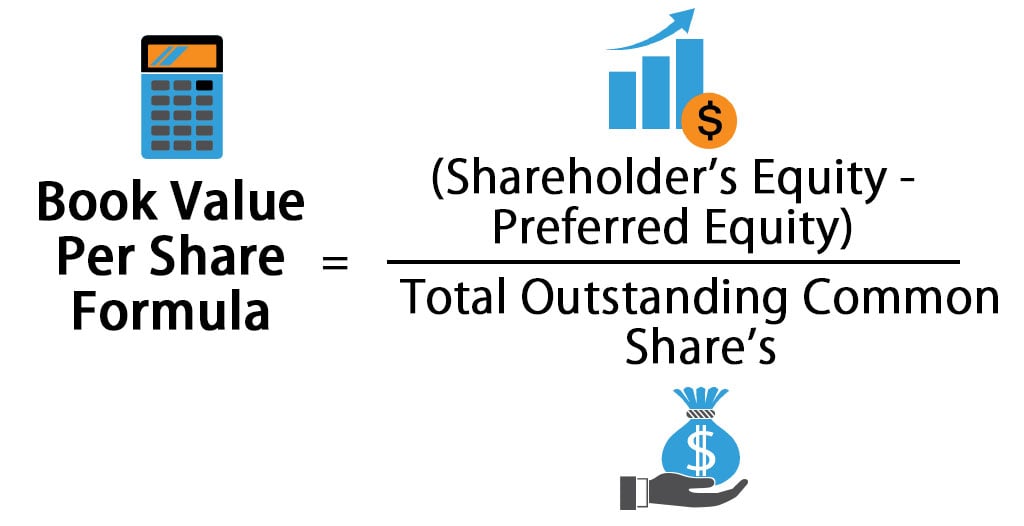

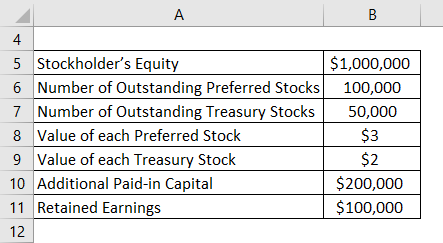

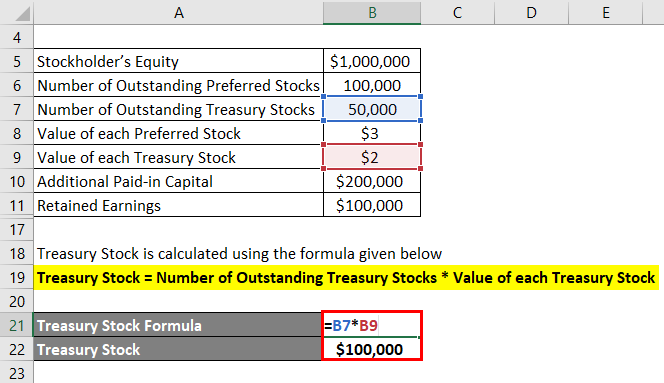

Book Value Of Equity Formula Example How To Calculate

Historical prices are adjusted for stock splits.

. Preferred Stock is a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock is calculated using Preferred Stock Dividend Discount RateTo. Ad Learn More About American Funds Objective-Based Approach to Investing. Ad Calculate the impact of dividend growth and reinvestment.

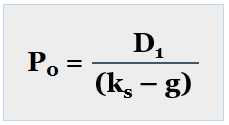

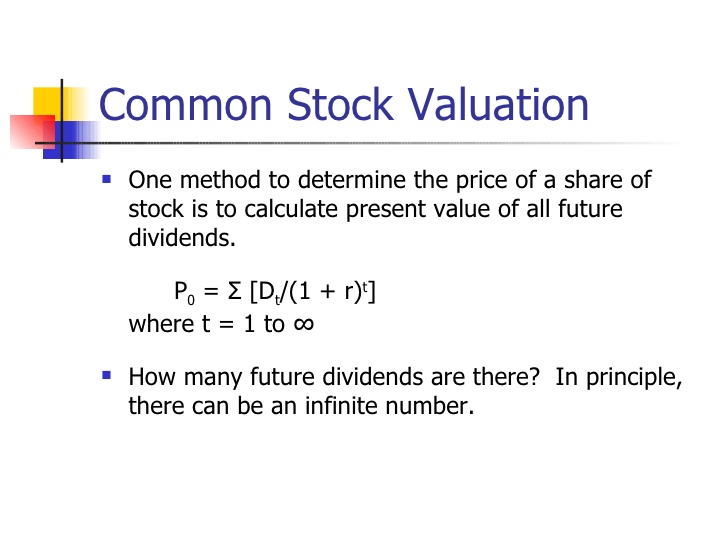

Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001 Then the following indicators are computed. Current Annual DividendsAnnual dividends paid to investors in the last year KRequired rate of return by investors in the market GExpected constant growth rate of the annual dividend. The Percent change in value of your holding since purchase.

Now from this data we have to calculate common stock by using the formula. Just follow the 5 easy steps below. V EPS 85 2 g where.

With a Focus on Client Goals American Funds Takes a Different Approach to Investing. If YES use this worksheet below to calculate the allocation of your cost basis between ATT Inc. - Total you will have to pay to purchase.

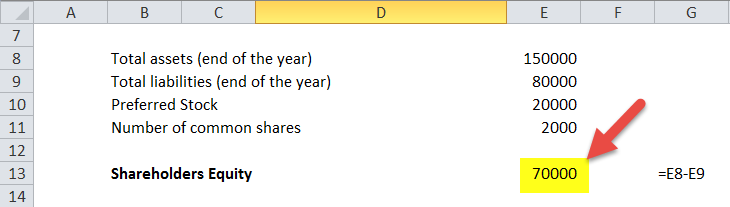

The Stock Calculator is very simple to use. And WBD common stock. The companys net asset value per share equals the companys.

Stock calculator that lets you figure out what a hypothetical investment would be worth today Step 1. This calculator will find solutions for up to four measures of the stock performance of a business or organization - earnings per share priceearnings PE ratio price. If you ask yourself how to determine the value of an asset be it a stock a bond or a piece of real estate you will most likely base your calculation on two factors.

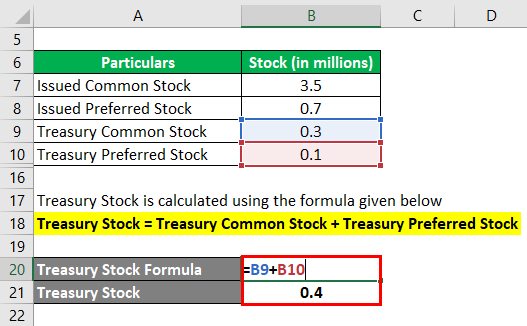

Screen compare over 30000 funds across the industry. Common stock Total EquityTreasury stock-Additional paid-incapital-preferred. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the.

To illustrate how to calculate stock value using the dividend growth model formula if a stock had. Shares on or after. Therefore in this calculator we will use a simple formula proposed by Benjamin Graham to determine the intrinsic value of a stock.

Remember that the needed rate of come back must be greater than the stock development rate in order for the dividend growth model in order to be used with regard to common stock value. But in this article we are only concerned with calculating the book value of the common stock. Select a purchase date Step 3.

The net asset value or book value is calculated by subtracting a companys total liabilities from its total assets.

Present Value Of Stock With Constant Growth Formula With Calculator

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

How To Calculate Cost Of Common Stock Equity Accounting Hub

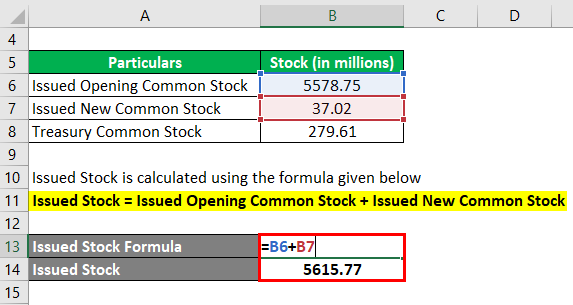

Shares Outstanding Formula Calculator Examples With Excel Template

Book Value Per Share Formula Calculator Excel Template

How Is A Company S Share Price Determined India Dictionary

Shares Outstanding Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

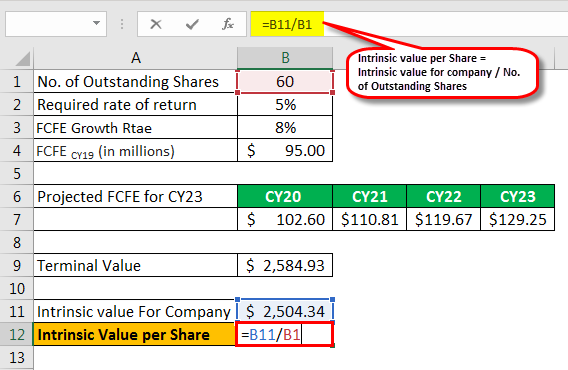

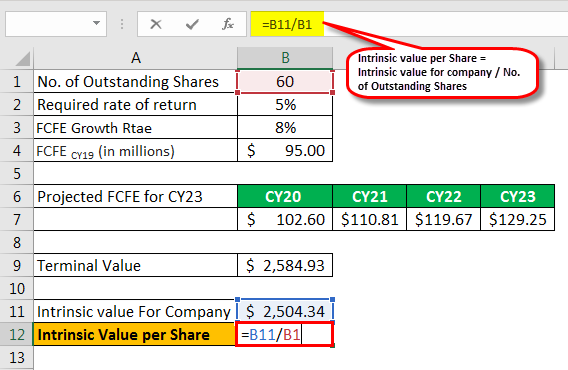

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Book Value Per Share Formula How To Calculate Bvps

Common Stock Formula Calculator Examples With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Common Stock Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

Stock Split Formula And Google Example Calculator Excel Template

Shares Outstanding Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template